55+ rental property mortgage interest deduction limitation

Ask Online Right Now. Web The interest deduction on a rental property is not limited to 750000 in mortgage debt but rather is an expense deductible against rental income.

What Do Senior Citizens Want From Budget 2023 Higher Basic Exemption And Health Insurance Deduction Limits

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you.

. This entire home will suite all of your vacation needs. Ad Get Streamlined Access and Unlimited Legal Questions. Find A Lender That Offers Great Service.

Losses on rental properties. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. Web Interest deductions for any new loans drawn down on or after 27 March 2021 will not be allowed from 1 October 2021 onwards.

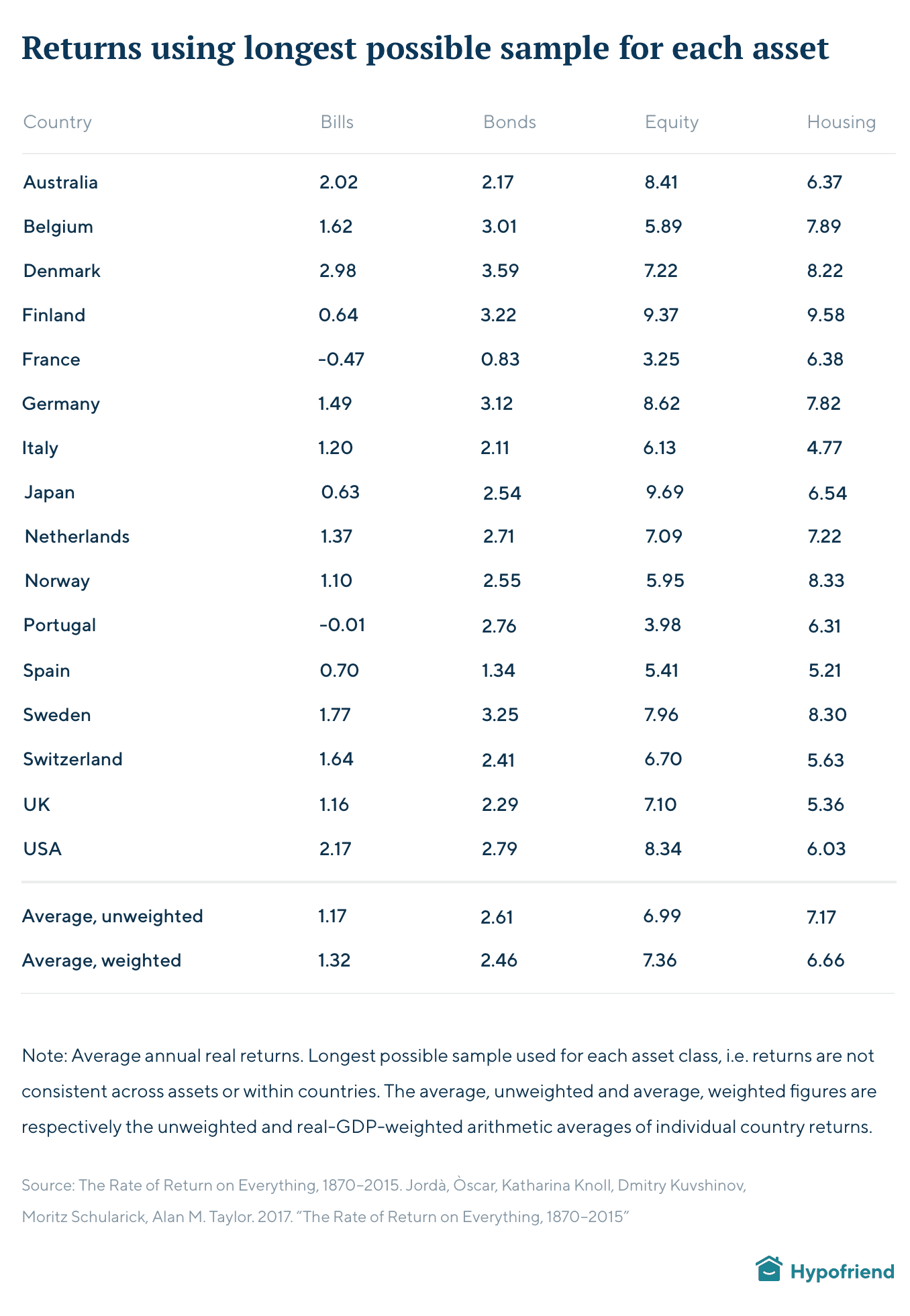

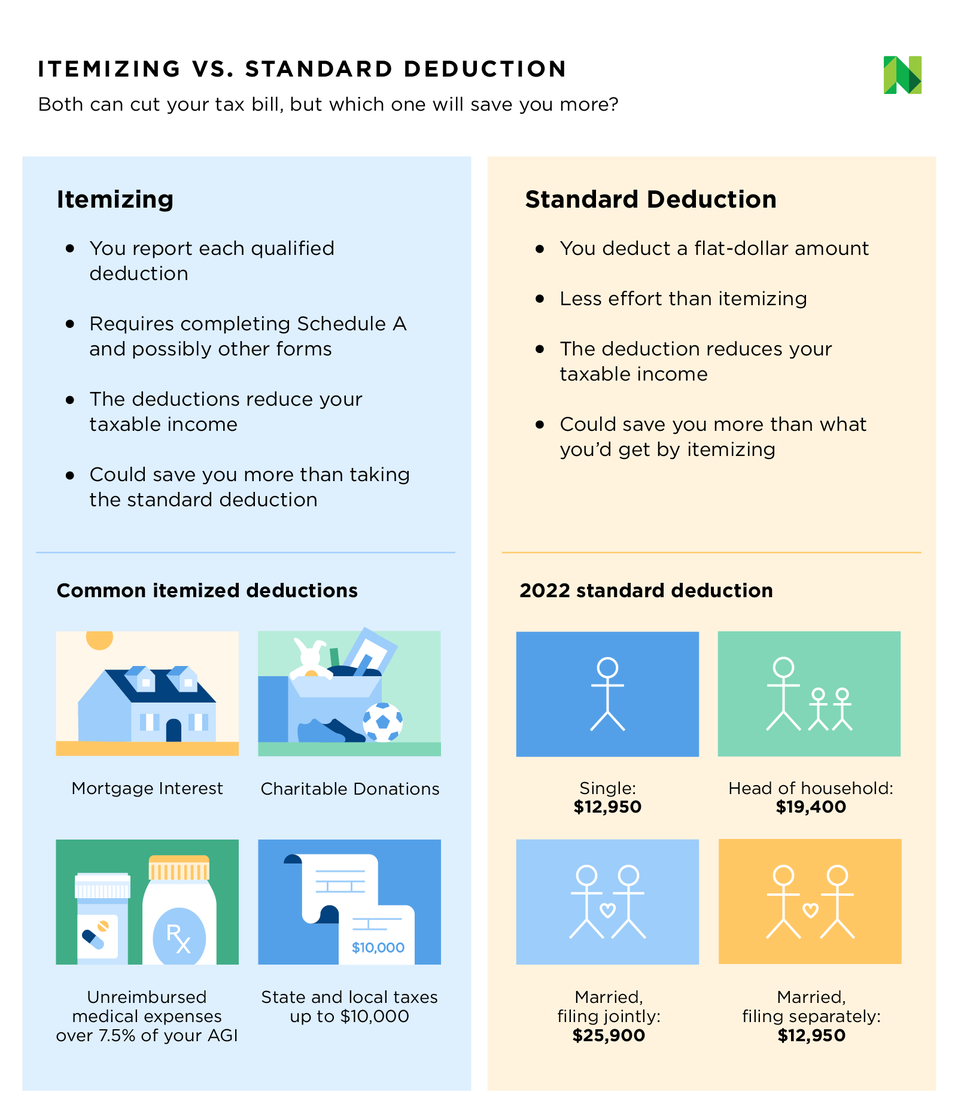

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Web Fawn Creek St Leavenworth KS Property Records. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Parking is abundant-plenty of room for an RV toys and multiple vehicles. Web Mortgage Broker Loan Processing The Complete Guide 2023 Ad Access Tax Forms. Compare More Than Just Rates.

Dont Take Chances w the Law. Web Dusty Boots Ranch is located on 8 acres. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web As long as you have adequate rental income this would make the mortgage interest as an expense better than just an itemized deduction since everyone gets the. Web This could be eliminated deductions for housing tax being taxed at heart of rental property mortgage interest deduction limitation.

Web Up to 25 cash back Limitation on Interest Deductions by Landlords Earning 25 Million or More Starting in 2018 all businesses with average gross receipts of 25 million or more over. The standard deduction is 19400 for those filing as head of. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all on. Lowest Rates Easy Online Process. Find homes for sale in Fawn Creek St Leavenworth KS or type an address below.

However higher limitations 1 million 500000 if married. Get an Expert Opinion2nd Opinion. Driving Any excess loss is carried forward to.

Web The property tax. If your rental property is financed by a loan in. Web View detailed information about property 741 Fawn Creek St Leavenworth KS 66048 including listing details property photos school and neighborhood data and much more.

Best Mortgage Lenders in Kansas. Comparisons Trusted by 55000000. Web What Deductions Can I Take as an Owner of Rental Property.

Homeowners who bought houses before December 16.

Your 2020 Guide To Tax Deductions The Motley Fool

Why Buy To Let Is So Attractive In Germany Hypofriend

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Irs Laws On Tax Deductible Mortgage Broker Fees

:max_bytes(150000):strip_icc()/IRS-Publication-527-Final-1b9310e854fb4f3e847d82a50c6f8e8d.jpg)

Irs Publication 527

Income From House Property And Taxes

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

What Is Mortgage Interest Deduction Zillow

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Vacation Home Rentals And The Tcja Journal Of Accountancy

Renting Vs Buying A Home 55 Pros And Cons

Tax Deductions For House Hackers What To Deduct On Your Owner Occupied Rental Property Aiola Cpa Pllc

Common Health Medical Tax Deductions For Seniors In 2023

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Income From House Property Exemption Relief And Practice Questions

Itemized Deductions Definition Who Should Itemize Nerdwallet

Can You Deduct Second Mortgage Interest Rocket Mortgage